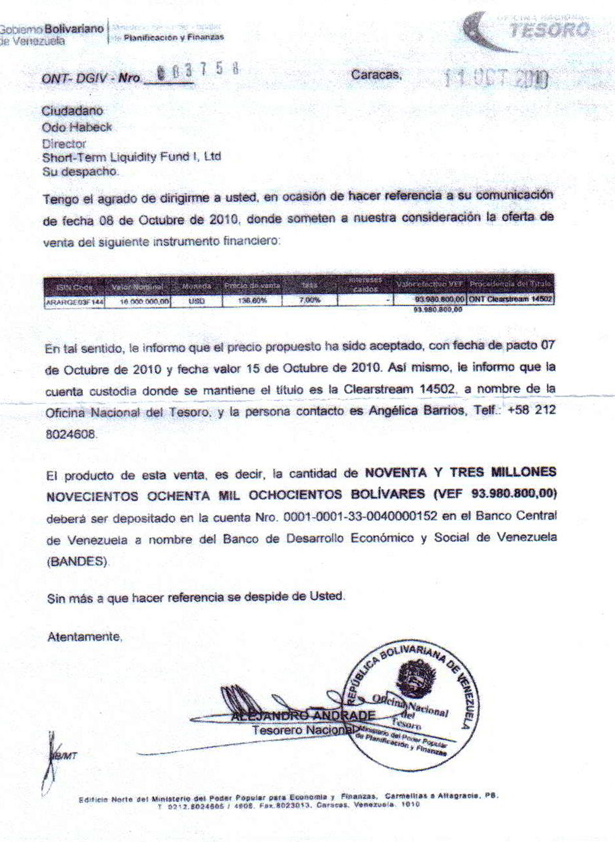

On October 11, 2010, Alejandro Andrade, former treasurer of Venezuela and former president of Banco de Desarrollo Económico y Social de Venezuela (Bandes), approved to sell Argentinian debt bonds own by Venezuela to Short-Term Liquidity Fund Ltd, one of the several American companies owned by Francisco Illaramendi, a Venezuelan-American broker who pleaded guilty of fraud before a court in Connecticut, USA. As shown in a letter signed by Alejandro Andrade (see below), Illaramendi’s companies received transfers in US dollars from PDVSA and the National Treasury Office.

Special Report from CuentasClarasDigital

In 2010, Venezuela was in the process of analyzing the results from the elections to the National Assembly, held on September 26. At the same time, Alejandro Andrade, head of the National Treasury Office and president of Bandes was signing a letter that would open the door to an operation benefitting a company in Cayman Island owned by Francisco Illaramendi, also president of Michael Kenwood Group. Accused of fraud against PDVSA and other Venezuelan investors by a Connecticut court, Illaramendi pleaded guilty of all charges and is currently waiting for sentence.

Andrade’s letter is addressed to the director of the Short-Term Liquidity Fund Ltd, Odo Habeck, a man with experience working for the World Bank in South America. Habeck was very close to Illaramendi. In 2004, according to a document from the U.S. authorities, PDV-USA hired Illaramendi and Habeck as advisors, following a request made by José Rojas, former director of the Venezuelan state oil company and former minister of Finance of Venezuela. Two years later, Illaramendi became CEO of the Michael Kenwood Group.

The document mentioned above, dated October 11, 2010 (three months before the U.S. authorities accused Illaramendi of fraud) responds to a communication sent by Habeck three days before, the 8th of October, in which Illaramendi requested to be sold ARARGE03F144 bonds with a nominal value of $ 16 million and for which Short -Term bid 93,980,800 million bolivars.

From the South

Those bonds were originally issued by the Argentinean Republic and sold to Venezuela in 2004 for US$ 12 million, along with other debt bonds from friendly countries like Ecuador.

Two years later, the Ministry of Finance of Venezuela, then headed by the current president of the Central Bank of Venezuela, Nelson Merentes, introduced Bono del Sur, a structured note composed by Argentinean and Venezuelan securities. Because the main purpose of this bond was to lower the price of the US dollar in the black market, investors could buy it in bolivars and get paid in U.S. dollars. In principle, this instrument would only be available through auctions and to national financial authorities. The trade with Short-Term Liquidity Fund Ltd did not meet these two criteria.

In his letter, Andrade informs Habeck that «the proposed price was accepted, with the covenant dated October 7, 2010, and the value dated October 15, 2010. The proceeds of this sale, i.e., a total of NINETY-THREE MILLION NINE HUNDRED EIGHTY THOUSAND EIGHT HUNDRED BOLIVARS (VEF 93,980,800.00) shall be deposited in the account No. 0001-33-0040000152 of Banco Central de Venezuela on behalf of Banco Económico y Social de Venezuela (BANDES) «. These where the instructions given and signed by Alejandro Andrade himself (see letter below).

The ARARGE03F144 bond’s historical record show that by October 15 the latter was worth 93.15% of its nominal value. Also by that time, the rate of the US dollar in the Venezuelan black market was about 8.04 bolivars per dollar.

On June 14, 2010, four months before Andrade signed the above-mentioned letter, the Superintendency of Banks (Superintendencia de Bancos de Venezuela, Sudeban) sent a communication to all public and private financial institutions in the country, stressing that buying and selling in bolivars securities that were denominated in foreign currency could only be made through the Transaction System for Foreign Currency (Sistema de Transacción con Títulos en Moneda Extranjera, SITME).

That same communication talked about the existence of an exception, but warned that those accepting the terms and conditions of this exception and negotiating bonds outside the SITME «must notify the regulatory agency (Sudeban)» within five business days following the date of any buying and selling transaction”.

The 2010 Comptroller General Annual Report (the last one signed by Comptroller Clodosvaldo Russián before passing away) observes that «BANDES, chaired by Alejandro Andrade, omitted the procedure established by SUDEBAN regarding the sale or exchange of securities; it is apparent that the sale and exchange of 84 structured notes were not covered by the document through which the Superintendency authorized the transaction; it also lacked the technical financial report justifying such operations. In the case of the exchanges, it was not considered the cost of converting investments made in euros to investments made in US dollars, based on the difference in the value of each currency’s rate by the time the operation was made and the interest earned» (page 100 of the Comptroller report).

Subsequent reports of the Comptroller General have not made any other reference to this case .

Questions for Andrade

The letter signed by former treasurer Alejandro Andrade raises a number of questions about the legality and effectiveness of an operation that benefited only one company—that of Francisco Illaramendi, who from 2005 until his fall in 2010 ran a Ponzi scheme to cover the financial gaps created by an administration that appropriated more than US $ 500 million from PDVSA retirees and workers.

So here are some questions that the former confidant of President Hugo Chávez should be able to answer:

Who authorized Alejandro Andrade to sell those bonds to Illaramendi’s company (Short-Term) and allow the latter to establish the conditions of the transaction? Did Andrade stepped over the minister of finance and the president of the Central Bank of Venezuela?

Was the exception mentioned by Sudeban justified in this case? Did Andrade inform Sudeban about the transaction?

Why did Andrade get a response in just three days?

Why was this operation made with a financial intermediary registered in the Virgin Islands?

Who lent the bolivars to Short-Term, Illaramendi’s company? Did Andrade benefitted from this transaction?

How much was the gain after selling the bonds in US dollar at the black market’s rate?

Did this transaction help to cover Illaramendi’s fraud?

To whom did Illaramendi resell the bonds? Would it be to the very National Treasury Office, as it happened with María de los Ángeles González Hernández, Bandes’ former Finance Manger?

How many operations like this did Andrade carry out?

Is this one of the 84 cases mentioned in the 2010 Comptroller General Report?

Why has not the Comptroller General penalized anyone for the 84 operations that were carried out without Sudeban’s authorization during Andrade’s chairmanship?

Is Andrade willing to come forward and answer these questions?